Key Insights for Investing in Factories in Vietnam

November 22, 2024 10:13 AM

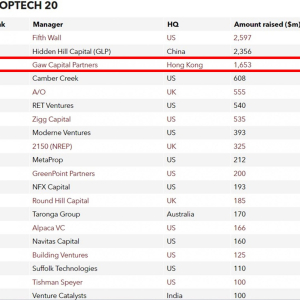

On November 11, 2024, Gaw NP Industrial and CSR HOME co-hosted the forum “Vietnam Investment Outlook: Market Opportunities and Practical Guidance” to discuss topics such as rental prices, taxes, labor costs, and more. The event attracted significant attention from Chinese business leaders and managers.

On November 11, 2024, Gaw NP Industrial and CSR HOME co-hosted the forum “Vietnam Investment Outlook: Market Opportunities and Practical Guidance” to discuss topics such as rental prices, taxes, labor costs, and more. The event attracted significant attention from Chinese business leaders and managers.

Q: What conditions must be met for manufacturing in Vietnam?

Raw materials sourced from Vietnam or raw materials/semi-finished products imported from other countries and processed or produced in Vietnam must have at least 30% of Vietnam’s domestic value-added, according to the international HS code. Previously, products could be manufactured locally, exported to Vietnam for assembly, but this is no longer allowed.

Q: Can firefighting and environmental protection equipment from abroad be easily imported into Vietnam, considering the differences in standards?

Firefighting and environmental permits are fully handled by the Vietnamese government. Therefore, it is advisable to work with a local entity to help complete the process. During the production phase, it is sufficient to obtain production licenses, quality inspection certificates, and other necessary documents.

Q: If a company’s Overseas Direct Investment (ODI) application is rejected, how long must they wait to reapply?

Reapplications can be made immediately, with no waiting period.

Q:What benefits do Vietnamese export processing enterprises (EPEs) offer to Chinese companies once they have established operations here?

EPEs enjoy exemptions from import duties and VAT on raw materials, fixed assets, and goods. Additionally, exported goods are exempt from export taxes and VAT.

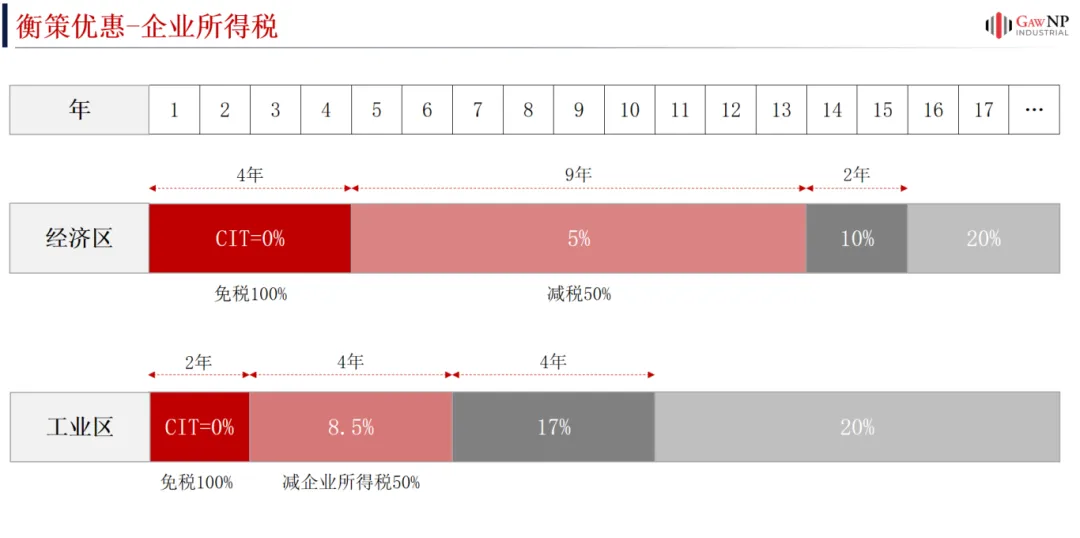

Corporate income tax (CIT) for EPEs is 17% for 10 years, starting from the first year of revenue generation. They are also exempt from CIT for 2 years and receive a 50% CIT reduction for the following 4 years.

GUEST SPEAKERS’ REMARKS

Industrial Internet Platform Yin Kongjian – Wang Shao Ping

- Priority sectors for investment promotion: Information technology, renewable energy, nanotechnology, biotechnology, healthcare, high-tech agriculture, and the digital economy.

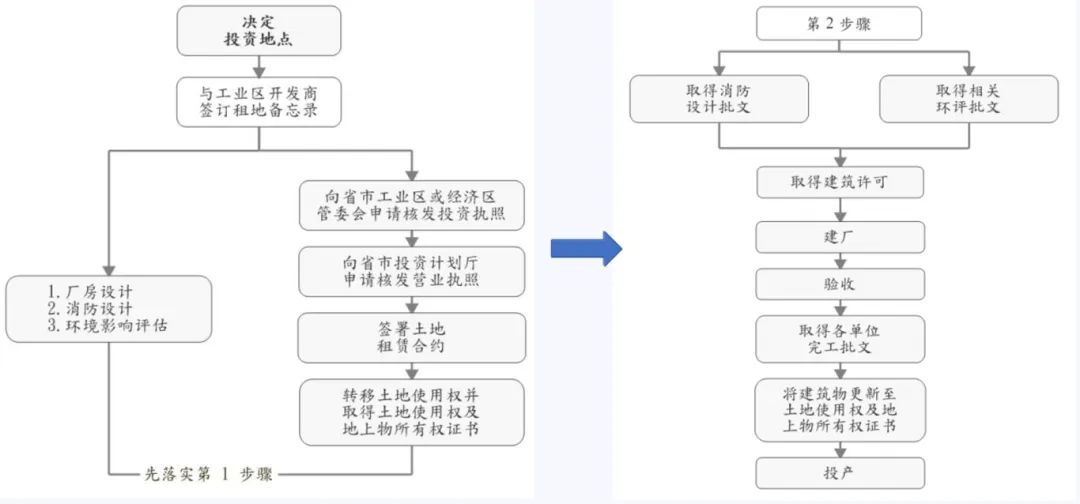

- Procedures for leasing land and constructing foreign-invested factories

Gaw NP Industrial – Mai Chi Hien

Exploring Opportunities for Leasing Ready-Built Factories in Northern Vietnam

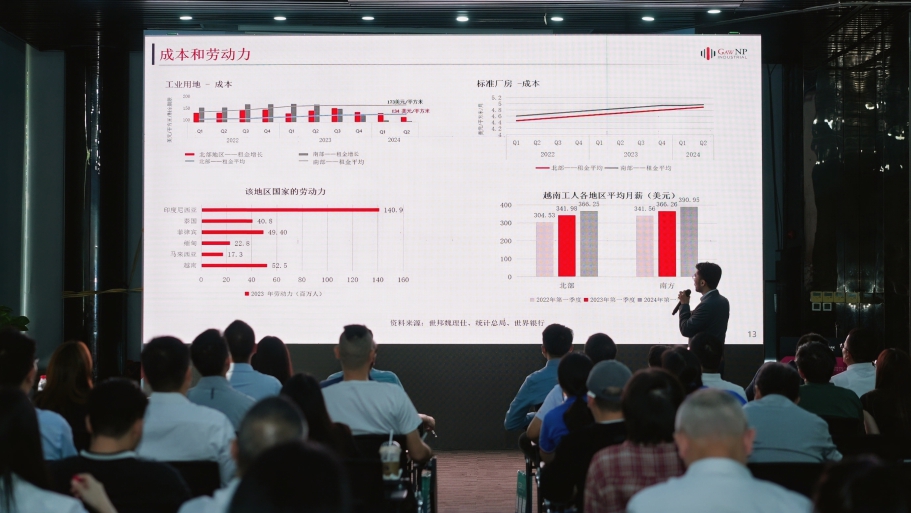

- In Q1 2024, the average monthly salary for workers in Northern Vietnam was $366.25, while in Southern Vietnam it was $390.95.

- In Q2 2024, the average industrial land rental price was $134/m² in Northern Vietnam and $173/m² in the South.

- The average rental cost for standard factories was $4.9/m² in the North and $5/m² in the South.

Hong Fu’an Cross-Border Business Services Group – Liu Shang

Legal, Taxation, and Customs Considerations for Investment in Vietnam

- Vietnam applies a CIT rate of 20% to all income generated within its borders. For activities involving the exploration, survey, and extraction of oil and gas, the CIT rate ranges between 32%-50%.

- VAT rates in Vietnam are categorized into three tiers: 0%, 5%, and 10%.

- A 0% VAT rate is applied to exported goods and services.

- A 5% VAT rate is applied to agriculture, healthcare, medical education, scientific and technological services, etc.

- A 10% VAT rate is applied to sectors such as petrochemicals, electronics, chemical machinery manufacturing, construction, and transportation.

- Starting January 1, 2024, the VAT rate for goods and services subject to the 10% rate will reduce by 2%, to 8%.

- Businesses will receive a 20% reduction in VAT tax rates for VAT invoices.

- Preliminary steps for filing an ODI application include:

- Legal Feasibility Analysis: Conduct legal due diligence in the target country, assess the investment environment, policies, regulations, and restrictions, while planning the investment structure and tax strategies.

- Streamlining Internal Decision-Making Processes: Prepare internal documents such as investment decisions, clear funding sources, investment plans, and ROI schemes, all of which must be approved by the board of directors or general shareholders’ meeting.

- Capital Documentation: Provide a detailed description of funding sources to demonstrate compliance and legality.

- Legal Documentation Preparation: Draft and compile the required legal documents for submission.

CSR – Wang Weihua

Considerations and Challenges for Entering the Vietnamese Market and Establishing New Companies and Factories

The goal is to construct a leading sustainable factory that sets benchmarks in the recycling industry.

Examples of sustainable factory production line design.

Warehouse for lease in Vietnam | Warehouse for rent in Vietnam | Factory for lease in Vietnam | Factory for rent in Vietnam